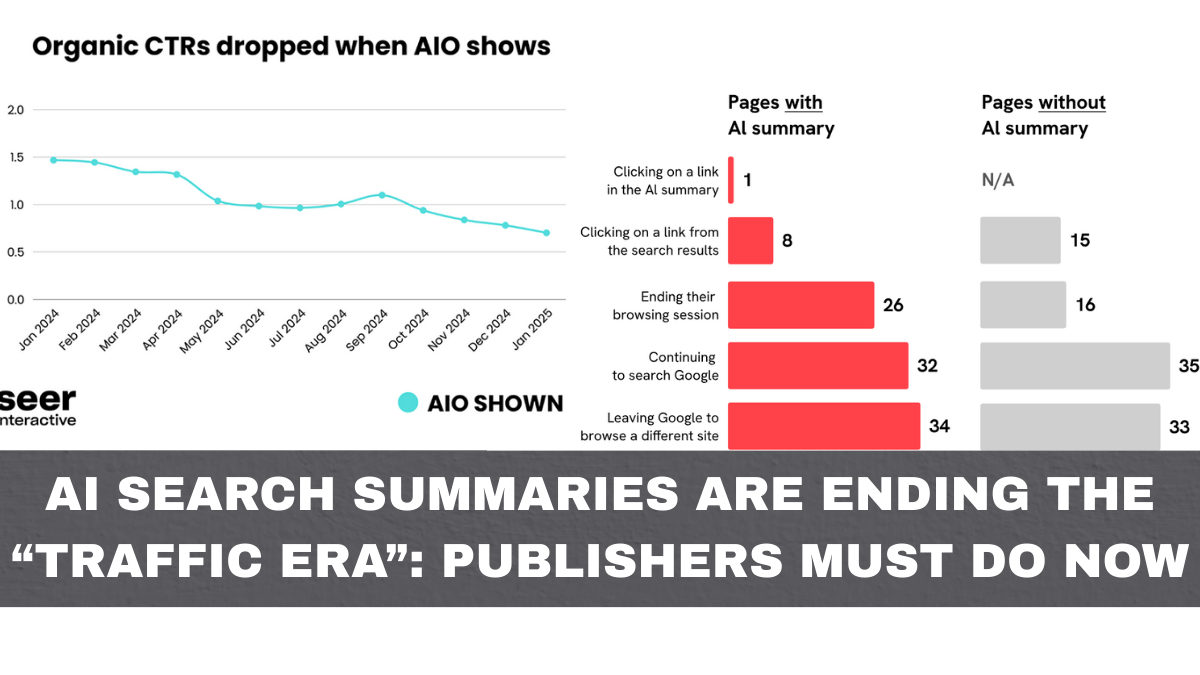

AI Search Summaries Are Ending the “Traffic Era”: What Publishers Must Do Now

The AI search summaries traffic drop is no longer a theory—it’s showing up in analytics dashboards across the web. Publishers are watching impressions stay flat or even rise while clicks fall off a cliff. The emotional reaction is predictable: panic, blame, and rushed SEO changes. The practical reality is harsher. The traffic model that rewarded … Read more