Income tax planning in India has become more confusing than ever in 2026, mainly because taxpayers are now expected to actively choose between two parallel systems. The income tax slabs 2026 under the old regime and the new regime continue to coexist, but the gap between them has widened in subtle ways. Many people assume the newer system is automatically better, while others stick to the old one out of habit without rechecking the math.

The real problem is not the slabs themselves, but misunderstanding how deductions, exemptions, and income structure interact with each regime. A choice that saves tax for one person can actually increase tax for another with a different salary profile. In 2026, blindly following advice without calculation is one of the costliest tax mistakes individuals make.

Income Tax Slabs 2026: What Has Actually Changed

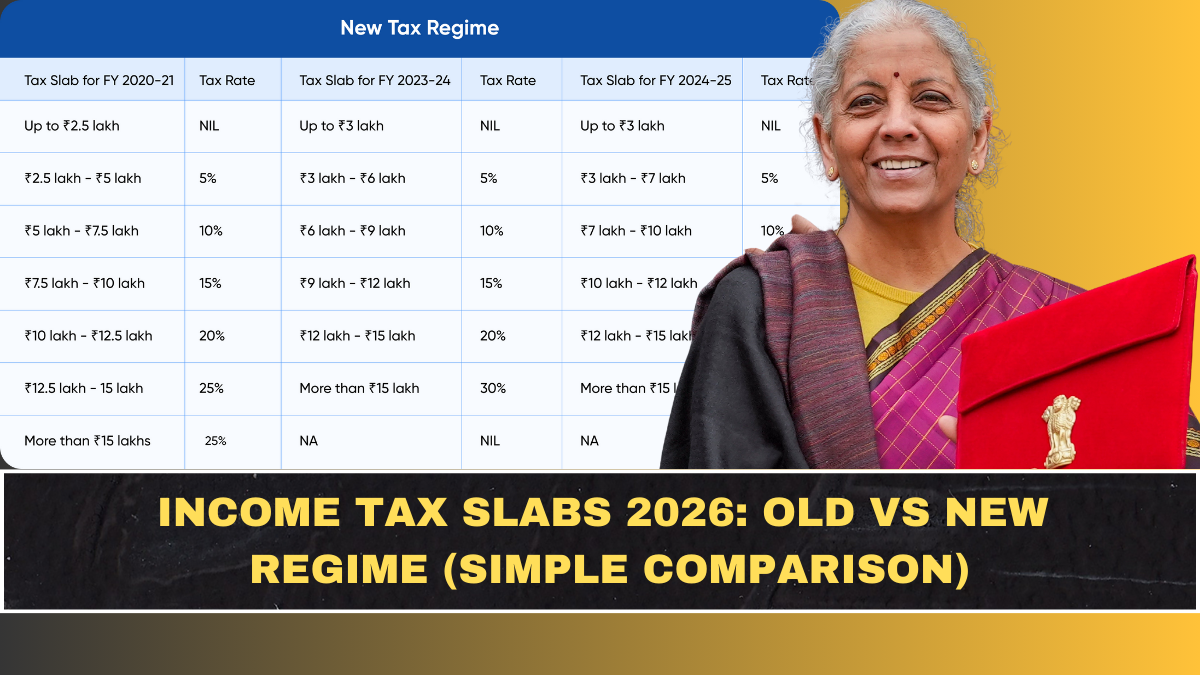

The income tax slabs 2026 largely continue the dual-regime structure, but the emphasis has shifted further toward the simplified new regime. The government has clearly signaled that the new regime is the default path, especially for salaried taxpayers who do not actively claim deductions.

Under the new tax regime, slab rates are designed to offer lower tax percentages across income ranges, but this comes at the cost of giving up most exemptions and deductions. The old regime, on the other hand, retains higher slab rates but allows multiple deductions that can significantly reduce taxable income.

What changed in 2026 is not a dramatic slab overhaul, but better alignment of standard benefits in the new regime, making it attractive for a wider group of taxpayers than before.

Old Tax Regime Explained in Simple Terms

The old tax regime remains familiar to long-time taxpayers. It allows deductions under sections like savings investments, insurance premiums, housing loan interest, and certain allowances.

This regime works best for individuals who actively plan their finances around tax-saving instruments. If you invest regularly, pay rent, have a home loan, or claim insurance deductions, the old regime can still lead to lower tax outgo.

However, the downside is complexity. Documentation, proof submission, and annual planning are unavoidable. In 2026, many taxpayers underestimate the effort required to fully benefit from the old system.

New Tax Regime Explained Clearly

The new tax regime was designed for simplicity. It offers lower tax rates across slabs but removes most deductions and exemptions. The idea is straightforward: pay tax on what you earn, without complex planning.

For people with fewer investments, no major deductions, or variable income patterns, this regime often results in lower or similar tax compared to the old system. It also reduces compliance stress, which matters more as tax systems become more automated.

In 2026, the new regime has become especially relevant for young professionals, gig workers, and those who prefer liquidity over locked-in tax-saving products.

Old vs New Regime: Who Should Choose What

Choosing between the two income tax slabs 2026 regimes depends entirely on income structure, not income amount alone. This is where most mistakes happen.

If a person earns a high salary but claims significant deductions through investments, insurance, and loans, the old regime usually works better. On the other hand, someone with a moderate salary and minimal deductions often benefits more from the new regime.

The key is calculation, not assumptions. Two people earning the same income can have completely different tax liabilities depending on deductions and exemptions claimed.

Common Mistakes Taxpayers Make in 2026

One major mistake is assuming the new regime is automatically cheaper. While rates are lower, losing deductions can increase taxable income more than expected.

Another common error is choosing the old regime without actually utilizing deductions fully. Simply having eligibility does not reduce tax unless deductions are actively claimed and documented.

Many taxpayers also fail to reassess their choice every year. Income structure changes over time, and a regime that worked earlier may no longer be optimal in 2026.

How to Compare the Two Regimes Properly

A proper comparison starts with listing your gross income, then identifying all deductions you realistically claim under the old regime. Only actual, not potential, deductions should be counted.

Next, calculate tax under both regimes using the same income base. This side-by-side comparison usually reveals the better option clearly.

In 2026, relying on assumptions or generic advice is risky because compliance systems are more precise and mismatches can trigger scrutiny.

Why the Government Is Nudging Taxpayers Toward the New Regime

The policy direction is clear. The government prefers a simpler, deduction-light system that is easier to administer and harder to misuse. The new regime aligns well with digital assessment and automated compliance.

While the old regime is still available, it increasingly favors those who plan intentionally. Over time, taxpayers who do not actively manage deductions may find the new regime more predictable and stress-free.

Understanding this direction helps taxpayers make informed long-term planning decisions instead of reacting year by year.

Conclusion: Choosing the Right Income Tax Slabs 2026

The income tax slabs 2026 do not demand blind loyalty to either regime. They demand clarity. The correct choice depends on how you earn, spend, save, and plan.

Instead of asking which regime is better in general, the smarter question is which regime fits your financial behavior. In 2026, the cost of choosing wrongly is not just higher tax, but also compliance issues and missed opportunities.

A simple calculation each year, based on realistic numbers, remains the safest way to optimize taxes without unnecessary stress.

FAQs

Are income tax slabs different under old and new regimes in 2026?

Yes, both regimes have different slab structures and tax rates, with the new regime offering lower rates but fewer deductions.

Can I switch between old and new tax regimes every year?

Salaried individuals can generally choose between regimes each year, while business income taxpayers may face restrictions on switching frequently.

Is the new tax regime better for everyone?

No, it depends on your deductions and income structure. Those with significant deductions may benefit more from the old regime.

What happens if I choose the wrong regime?

Choosing the wrong regime can result in higher tax outgo, but it does not usually attract penalties if reported correctly.

Do deductions like insurance and PPF apply in the new regime?

Most traditional deductions do not apply under the new tax regime, which is why calculation is essential before choosing.

Which regime is simpler from a compliance perspective?

The new tax regime is simpler as it requires fewer documents and less ongoing tax planning.