Understanding how your CTC converts into actual in-hand salary is one of the most misunderstood parts of employment in India, even in 2026. Many employees look at the headline CTC number and assume that most of it will land in their bank account every month. The shock usually comes with the first payslip, when deductions, contributions, and exclusions suddenly appear and the take-home figure looks far smaller than expected.

The problem is not that companies are hiding money. The problem is that CTC is a broad cost figure, not a cash figure. It includes multiple components that may never reach your bank account directly. Once you understand how CTC to in-hand salary actually works, salary negotiations, job comparisons, and financial planning become far more realistic and less stressful.

What CTC Really Means in 2026

CTC, or Cost to Company, represents the total amount an employer spends on an employee in a year. This includes not only salary paid to you, but also statutory contributions, benefits, and certain reimbursements. Many of these components are valuable, but they are not liquid cash.

In 2026, CTC structures have become more standardized due to tighter payroll compliance and digital reporting. Employers clearly split fixed pay, variable pay, statutory contributions, and benefits. However, employees often focus only on the total figure without understanding the internal composition.

This gap in understanding leads to unrealistic expectations. Knowing what CTC actually includes is the first step to estimating your true in-hand salary correctly.

Major Components Inside a Typical CTC Structure

A standard CTC is divided into fixed salary, employer contributions, variable pay, and benefits. Fixed salary usually includes basic pay, house rent allowance, and other monthly allowances that form the base of your take-home.

Employer contributions such as provident fund and insurance are part of CTC but are not paid to you as cash. Variable pay may depend on performance or company policy and is often paid annually rather than monthly.

Benefits like insurance, gratuity accrual, or meal cards add value but do not increase monthly cash flow. In 2026, these components are clearly listed but still widely misunderstood.

How Provident Fund Impacts In-Hand Salary

Provident fund is one of the biggest reasons CTC and take-home differ significantly. Both employee and employer contributions are calculated as a percentage of basic salary. While the employer’s contribution is part of CTC, the employee’s contribution is deducted from gross salary.

This means PF reduces monthly in-hand salary but builds long-term savings. Many employees see PF as a loss, but it is essentially deferred income with tax benefits.

In 2026, PF compliance is stricter, and opting out is limited. Understanding this deduction helps avoid frustration when comparing offers with similar CTC but different basic salary structures.

ESI, Gratuity, and Other Mandatory Components

For employees under certain salary thresholds, ESI deductions may apply. These reduce in-hand salary slightly but provide health coverage and social security benefits.

Gratuity is another component included in CTC but not paid monthly. It accrues over time and becomes payable only after meeting eligibility conditions. Until then, it exists only on paper.

Other statutory costs like insurance premiums may also be included. These do not increase take-home pay but do reduce out-of-pocket expenses later.

Income Tax and Its Role in Take-Home Pay

Income tax is the most visible deduction affecting in-hand salary. Tax liability depends on total taxable income, chosen tax regime, and applicable deductions.

In 2026, employers usually deduct tax at source every month, spreading the impact across the year. This makes monthly salary predictable but reduces immediate cash availability.

Incorrect tax declarations or delayed updates can lead to higher deductions during later months, which can disrupt budgeting if not planned properly.

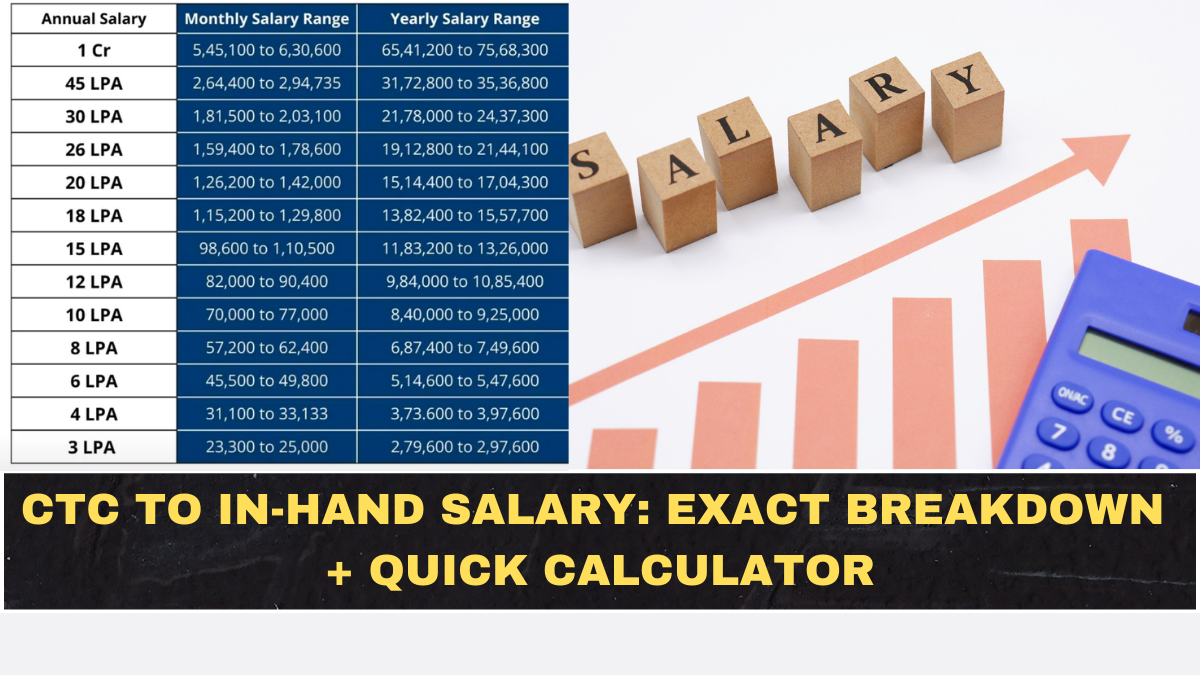

CTC to In-Hand Salary: A Simple Way to Estimate

To estimate in-hand salary, start by removing employer-only components from CTC. Next, calculate gross salary, then subtract employee PF, ESI if applicable, and estimated monthly tax.

What remains is your approximate take-home pay. While exact numbers vary by structure, this method gives a realistic range rather than a misleading figure.

In 2026, many payroll tools automate this process, but understanding the logic helps you verify accuracy and avoid surprises.

Common Mistakes Employees Make While Comparing Offers

One common mistake is comparing two job offers purely on CTC numbers. A higher CTC with a larger basic salary deduction can sometimes result in lower take-home than a slightly lower CTC with smarter structuring.

Another mistake is ignoring variable pay timing. Annual bonuses included in CTC do not help monthly cash flow and should not be counted when planning expenses.

Employees also overlook benefits like insurance value or gratuity accumulation, focusing only on monthly salary, which gives an incomplete picture.

How to Negotiate Salary the Smart Way

Instead of negotiating only on CTC, it is more effective to discuss fixed pay and take-home expectations. Asking for clarity on basic salary percentage, variable components, and deductions leads to better outcomes.

In 2026, employers are more open to transparent discussions because payroll structures are standardized. A clear conversation can help align expectations on both sides.

Negotiation should focus on stability and predictability rather than just the highest headline number.

Conclusion: Think Beyond the CTC Number

CTC to in-hand salary conversion is not a trick; it is a system designed to bundle cash, savings, and benefits together. The confusion arises when employees treat CTC as disposable income rather than total cost.

Understanding the breakup empowers you to make better career decisions, plan finances accurately, and avoid disappointment. In 2026, financial awareness is no longer optional for salaried professionals.

A realistic view of take-home pay helps you focus on what truly matters: stability, growth, and long-term financial health.

FAQs

What is the difference between CTC and in-hand salary?

CTC is the total cost incurred by the employer, while in-hand salary is the amount you actually receive after deductions.

Does employer PF contribution increase my take-home pay?

No, employer PF is part of CTC but is deposited into your PF account, not paid as cash.

Why is my in-hand salary much lower than my CTC?

Because CTC includes deductions, contributions, and benefits that do not translate into monthly cash.

Can I increase my in-hand salary without increasing CTC?

Sometimes yes, by restructuring salary components, optimizing tax declarations, or adjusting benefits.

Is variable pay included in monthly salary?

Usually no. Variable pay is often paid quarterly or annually and should not be counted as monthly income.

Should I negotiate CTC or take-home salary?

It is better to negotiate clarity on fixed pay and take-home expectations rather than focusing only on CTC.